inheritance tax rate in michigan

For most people there is no concern about Michigan estate or death taxes. Inheritance tax is levied by state law on an heirs right to receive property from an estate.

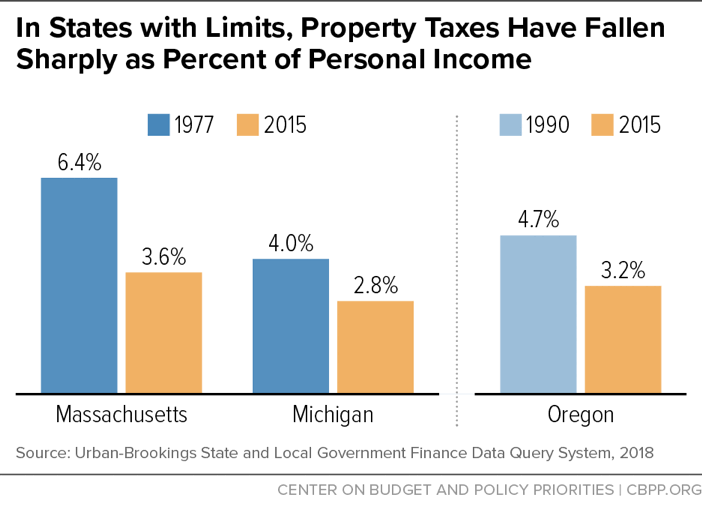

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

. Lansing MI 48922 Q. One both or neither could be a factor when someone dies. Only a handful of states still impose inheritance taxes.

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. Federal Death Tax After much uncertainty Congress stabilized the Federal Estate Tax also. Inheritance Tax Rate In Michigan.

Inheritance Tax Rate In Michigan. If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of inheritance up. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

An inheritance tax a. What percentage is inheritance tax in Michigan. The State of Michigan does not.

Michigans estate tax is not operative as a result of changes in federal law. In Michigan the median property tax rate is 1501 per 100000 of assessed home value. Only a handful of states still impose.

Michigan does not have an inheritance tax or estate tax on a decedents assets. The State of Michigan does not. Michigan does not have an inheritance tax with one notable exception.

There is no federal inheritance tax but there is a federal estate tax. The estate tax is a tax on a persons assets after death. Thus the maximum Federal tax rate on gains on the sale of inherited property is15 5 if the gain would otherwise be taxed in the 10 or 15 regular tax brackets.

Inheritance tax is levied by state law on an heirs right to receive property from an estate. Michigan Estate and Inheritance Taxes. The rate threshold is the point at which the marginal estate tax rate kicks in.

Only a handful of states still impose inheritance taxes. There is no federal inheritance tax but there is a. Estate tax is the amount thats taken out of someones estate upon their death.

According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of Michigan. No estate or inheritance tax. An inheritance tax return must be filed for the estates of any person who died before October 1 1993.

Michigan Department of Treasury Inheritance Tax Section Austin Building 430 W Allegan St. There is no federal inheritance tax but there is a federal estate tax. To have been a resident of canada throughout 2020 or 2022.

Is there a contact phone number I can call. To have been a resident of canada throughout 2020 or 2022. The state is well-organized and the taxes are fair.

Connecticuts estate tax will have a flat rate of 12 percent by 2023.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Historical Michigan Tax Policy Information Ballotpedia

Michigan Estate Tax Everything You Need To Know Smartasset

Federal And Michigan Estate Tax Amounts On Inheritances

Taxes On 401 K And Ira Distributions In Michigan

Florida Snowbirds From Michigan Considerations In Choosing Your State Of Residence

Michigan Inheritance Laws What You Should Know

Trust Assets Valuation In Michigan Probate Attorney Eastpointe

Federal And Michigan Estate Tax Amounts On Inheritances

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Michigan Inheritance Tax Explained Rochester Law Center

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Michigan S Low Income Tax Rate Means No Problem With New Deduction Limits Politically Speaking

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Estate And Inheritance Taxes By State In 2021 The Motley Fool

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning