putnam county property tax appraiser

The Putnam County Property. The goal of the Putnam County Assessors Office is to provide the people of Putnam County with a web.

Broward County Property Appraiser

Putnam County Property Appraiser.

. Putnam County property owners have the option to pay their taxes quarterly. The accuracy of the information provided on this website is not guaranteed for legal purposes. Upon completion the tax roll is then certified to the Tax Collector who prints and mails the tax notices.

If you do not know your property. Remember to have your propertys Tax ID Number or Parcel Number available when you call. Our department is designed to function as the educational advisory and assistance arm of County.

Putnam County Tax Collector. Instead contact this office by phone or in writing. Enter the Property ID and click Search to locate your property account information.

Installment payments are made in June September December and March. Putnam Country Tax Assessors Office Website. My goal as your Assessor is to serve with honesty integrity and professionalism and.

Using these figures the Property Appraiser prepares the tax roll. In Florida Property Appraisers are independent constitutional. Click to Email us.

The Putnam County Property Appraisers office makes no warranties expressed or implied as to the correctness accuracy or reliability of this Tax Estimator. Gilmore car museum 2022 schedule. Current Tax Installment Plan.

Putnam County Property Appraiser. The Putnam County Property Appraisers office makes no warranties expressed or implied as to the correctness accuracy or reliability of this Tax Estimator. You can call the Putnam County Tax Assessors Office for assistance at 765-653-4312.

Changes occur daily to the content. Just another site putnam county assessor. The Putnam County Property.

To be completed by Putnam County property owners. In Florida Property Appraisers are independent constitutional. Exemptions applications for Real.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. Failure to comply with this state law could result in costly penalties to the county and consequently passed on to the taxpayer. You can call the Putnam County Tax Assessors Office for assistance at 419-523-6686.

Business owners need to file their Tangible Personal Property Return form DR-405 with the Property Appraisers Office. Putnam County Property Appraiser. This office is open to the public from 800 AM until 500 PM Monday through Friday.

In Florida Property Appraisers are independent constitutional. As your Putnam County Assessor I Gary Warner would like to personally welcome you to my website.

Upcoming Grand Jury Appointment To The Board Of Equalization Notice Application

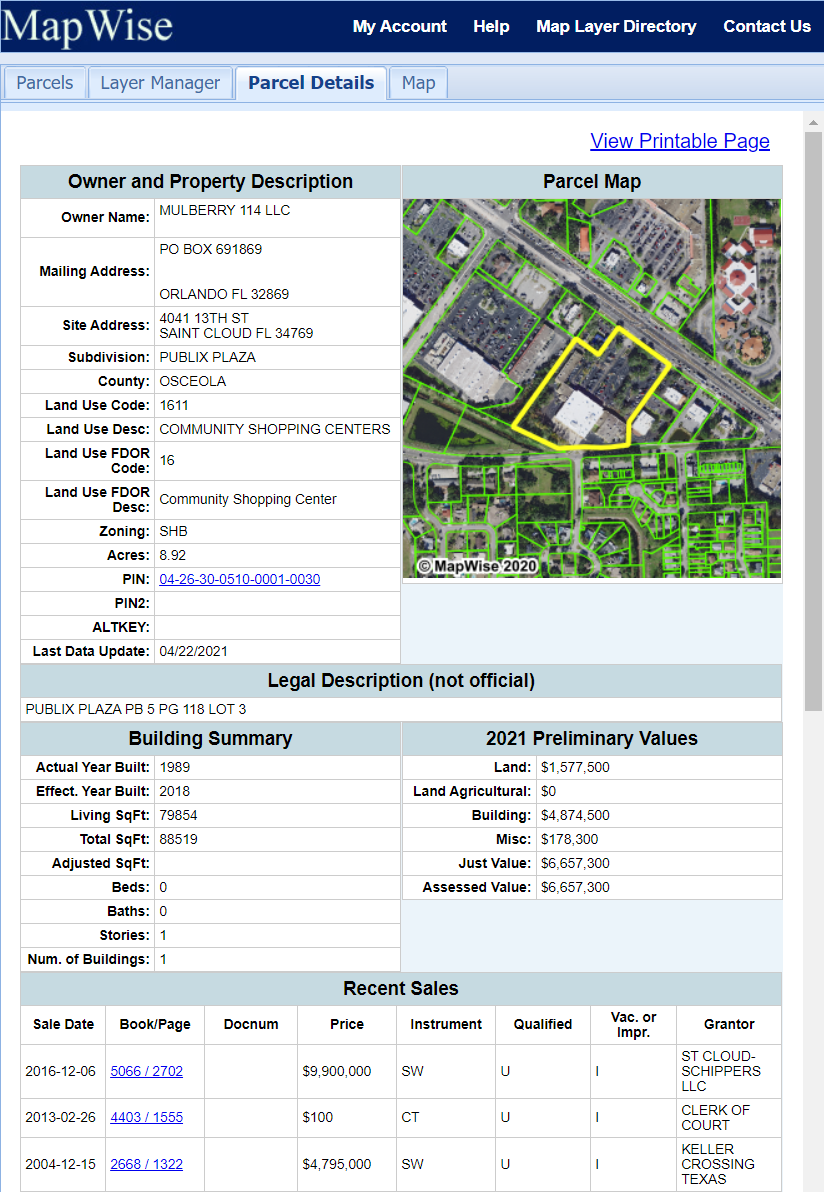

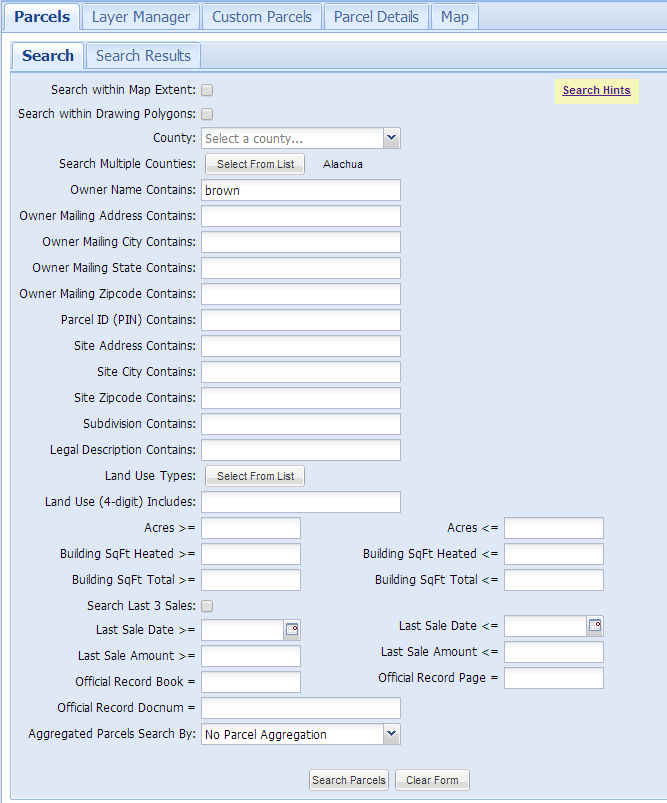

Florida County Property Appraiser Search Parcel Maps And Data

Property Appraiser Putnam County Florida

Putnam County Clerk Of The Circuit Court Comptroller

Property Taxes Citrus County Tax Collector

Putnam County Tax Assessor S Office

Tennessee Property Data Home Page

Sarasota County Property Appraiser How To Check Your Property S Value

0 25 Acre Lot With Trees In Putnam County Land Property By Landestiny

Florida County Property Appraiser Search Parcel Maps And Data

Peyton Trims Proposed Tax Hike For Duval Property Owners

Chuck Anglin Putnam County Georgia

Tax Offices Closed Deadlines Extended Palatka Daily News Palatka Florida

1134 Highway 19 Palatka Fl 32177 Compass

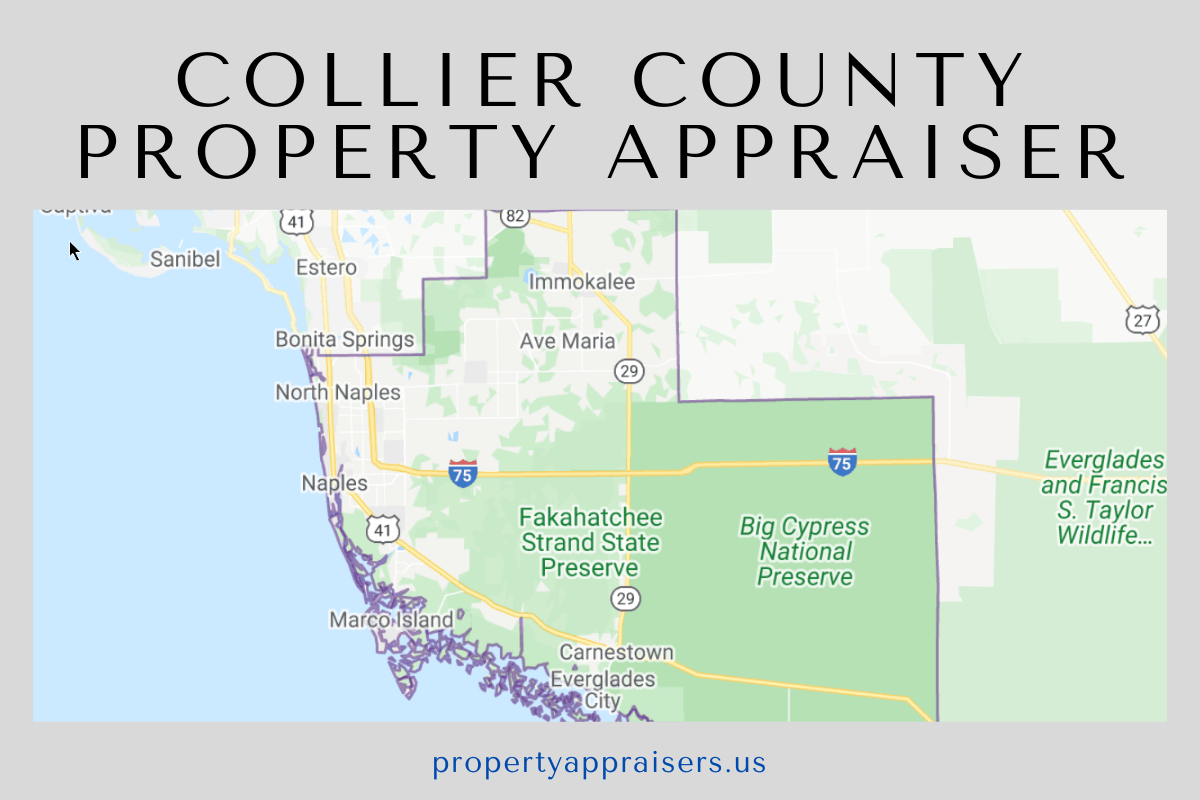

Collier County Property Appraiser How To Check Your Property S Value

320 Edgewood Drive Georgetown Fl 32139 Compass

Broward County Property Appraiser